After Posting Ends

This is where social listening becomes a planning tool.

What to monitor

- Phrases people repeat without being prompted

- Concerns that persist after the campaign ends

- How long campaign language sticks around once spend drops

- Whether competitor mentions increase or fade

What to do with it

- Add findings to the next creator brief

- Update creator selection criteria based on comment quality, not only reach

- Save proven audience language for future briefs

Applying Engagement and Social Listening Insights in Real Time

Once you can see both reaction and conversation, you can make changes that protect performance while a campaign is still running. UGC engagement sentiment helps you tell whether reactions are excitement, hesitation, confusion, or pushback, without guessing from a handful of comments.

The key is to treat repeated comment themes as a signal.

Pattern: Comments Focus on Price

What it usually means

People are interested, but deciding whether the value is there.

What to change

- Ask creators to lead with value and practicality, not hype

- Add proof formats like wear tests, close-ups, or “how long this lasted” checks

- Shift amplification toward creators whose comments show practical intent questions

Pattern: Comments Focus on Shade Match or Inclusivity

What it usually means

Fit and representation are central to the decision.

What to change

- Adjust creator mix and creative direction so more viewers can see themselves in the content

- Prioritize swatch and application formats that answer questions quickly

- Amplify posts where the comment section shows clearer choice and fewer repeated questions

Pattern: Comments Show Confusion About Use

What it usually means

Interest is there, but the message is not landing clearly.

What to change

- Tighten the first few seconds so the use case is obvious

- Add one short “how to use it” asset to the content mix

- Update the brief so creators include one clear use-case sentence in their own words

Pattern: Competitor Mentions Spike

What it usually means

People are comparison shopping in the category.

What to change

- Decide whether to address comparisons directly or keep the focus on fit and use case

- Emphasize the feature people keep comparing, such as wear time or finish

- Use formats that show differences quickly, like short demos or routine placement

Pattern: Tone Turns Skeptical While Engagement Stays High

What it usually means

The campaign may be overexposed, or the message is attracting the wrong audience.

What to change

- Pull back amplification on the posts driving the wrong tone

- Rotate creators and angles so the content does not feel repetitive

- Focus spend on relevance, not reach, so the comments stay useful and specific

Rare Beauty vs. Fenty Beauty: what social listening helps you catch early

Both Rare Beauty and Fenty Beauty can pull strong engagement. The difference shows up when you read the comments. One campaign can drive “this is for me” language and confident buying questions. Another can drive lots of reactions but very little meaning behind them.

Here’s the practical takeaway: two posts can look equally strong in engagement data, but require completely different next moves. Social listening helps you decide whether to protect what is working, clarify what is confusing, or add proof for people who are still deciding.

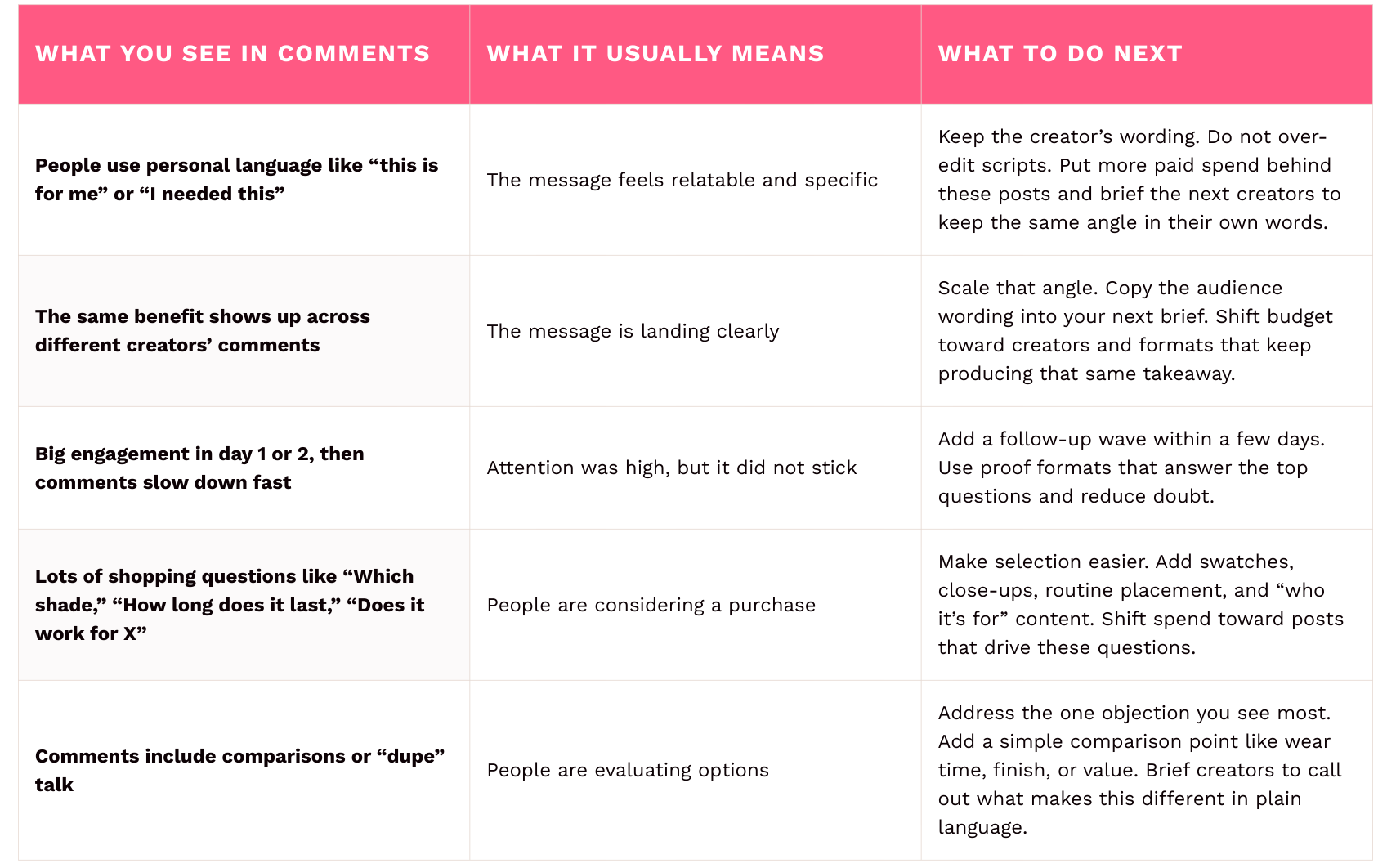

Comment Patterns That Tell You What to Do Next

How to Apply This Mid-Campaign

If You See “This Is for Me” Language, Protect Voice and Consistency

Here’s what “protect” looks like in practice:

- Do not rewrite creators into the same talking points.

- Keep the hook structure that is working.

- Put more amplification behind the posts where those comments show up.

- Brief the next wave with the same angle, but ask for their words, not yours.

If You See Quick Spikes and Short Reactions, Add Proof Fast

Quick spikes means: views and likes jump early (often in the first 24 to 48 hours), then drop off quickly.

Short reactions means comments like: “love,” “need,” “obsessed,” emojis, or one-word replies, with few real questions.

That combo usually means the content grabbed attention, but people still do not understand value, fit, or why it matters.

Proof formats are the fixes that reduce doubt, for example:

- wear test or time check (“after 6 hours”)

- close-up texture shots

- routine placement (“here’s where it fits in my routine”)

- shade match walkthrough or swatch set

- “who this is for” and “who it’s not for”

- side-by-side demo of two finishes or two shades

Check UGC Engagement Sentiment by Creator

Instead of treating the campaign as one big bucket, you compare comment tone by creator:

- Creator A’s comments show confident intent questions.

- Creator B’s comments show price pushback or skepticism.

- Creator C’s comments show confusion about use.

That tells you exactly where to shift the budget and what to change in the next brief. It also keeps you from scaling a post just because engagement is high.

What Brands Should Be Listening For in Influencer Marketing in 2026

If you only listen for brand mentions, you miss signals that shape performance before your brand is even named. In influencer marketing 2026, the teams that win are the ones who can read category expectations and audience concerns early, not just report on them later.

Pay attention to

- Category conversations that set expectations

- Competitor sentiment during your campaign window

- Differences in audience reactions by platform

- Emerging objections that slow momentum

In practice, brand sentiment analysis is less about a single score and more about repeated language and tone. The most useful question is simple: are people moving toward interest and intent, or cycling through doubt and objections.

Turning Engagement Data and Social Listening into a Repeatable Campaign Loop

The point is not a longer report. It is faster learning and clearer decisions next time.

1) Capture Repeated Audience Language

Write down the phrases that show up across creators and platforms. Do not rewrite them in brand language.

2) Separate Engagement Volume From Conversation Quality

Two creators can drive similar engagement and produce very different comment sections. Track who drove intent questions and who drew repeated objections.

3) Write Changes as Decisions

Avoid “improve messaging.” Write specific decisions you would make next time:

- Brief: one line to add, one line to remove

- Messaging: one point to emphasize earlier

- Formats: one to add, one to reduce

- Spend: where to increase, where to pull back

These decisions become part of your influencer campaign analytics, because they explain what changed and why, not just what performed.

4) Put the Learnings Into the Next Brief

Do not bury it in a recap deck. Add a one-page addendum creators and planners will actually use.

What You Can Do Next

Engagement data tells you what got a reaction. Social listening tells you what people mean, what they doubt, and what they want next. That understanding is now part of performance work, not an extra step.

Brands that build this loop for every campaign improve faster. They make clearer briefs, choose creators more precisely, and adjust messaging and spend based on real audience signals instead of guesswork.

FAQs

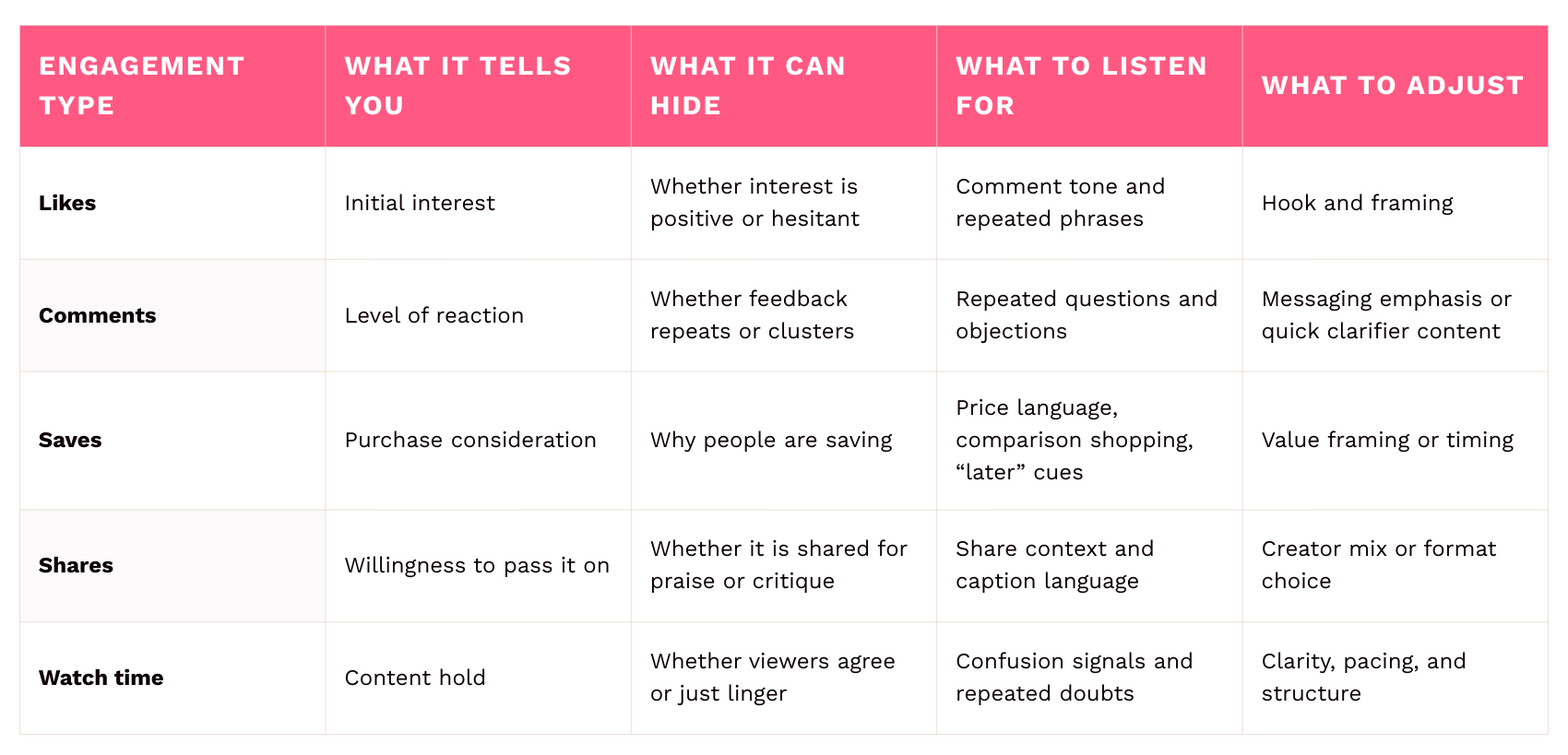

What Is Engagement Data in Influencer Marketing?

Engagement data in influencer marketing refers to how audiences interact with creator content. That includes likes, comments, saves, shares, and watch time.

Engagement data shows how much reaction a post generated, but it does not explain what people mean in their comments or whether the reaction is positive, hesitant, or confused. To understand that, teams pair engagement data with social listening and brand sentiment analysis.

How Is Social Listening Different From Engagement Data?

Engagement data measures the volume of reactions. Social listening looks at the language inside those reactions.

For example, a post might have high engagement, but social listening can reveal whether comments focus on price concerns, confusion about use, or strong buying intent. Used together, engagement data and social listening give teams both the reaction and the reason behind it.

How Can Brands Use Engagement Data While a Campaign Is Still Live?

Brands can use engagement data mid-campaign by separating attention from intent.

If engagement is high but comments show confusion or repeated objections, teams can update briefs, adjust messaging, add proof formats, or shift spend toward creators driving clearer buying questions. Tracking UGC engagement sentiment across creators helps teams decide where to scale and where to refine before the campaign ends.

How Can Brands Use Engagement Data While a Campaign Is Still Live?

In influencer marketing 2026, brands are expected to improve campaigns while they are still live, not just report results after they end.

Engagement data matters because it shows where attention and interest are building. But in 2026, engagement data alone is not enough. Teams also rely on social listening and brand sentiment analysis to understand what audiences mean, not just how many reacted.

Tags:

Engagement Data

%20and%20How%20Can%20They%20Benefit%20Your%20Brand%20article.jpg?length=628&name=What%20Are%20Key%20Opinion%20Leaders%20(KOL)%20and%20How%20Can%20They%20Benefit%20Your%20Brand%20article.jpg)