Introduction

Influencer marketing has become one of the most indispensable forms of digital marketing worldwide. With millions of internet users connecting every day to chat, browse, shop, and learn, it comes as no surprise that marketers have harnessed the power of online influencers to inform, inspire, and ultimately guide consumers to their products.

Partnering with these content creators can improve brand awareness and create a connection with audiences that is difficult to achieve with traditional ads. It’s due to this popularity that the influencer marketing sector is set to grow to approximately $16.4 billion worldwide by the end of 2022.

Europe itself is home to some of the world’s largest digital ad markets. To gain insight into this ever-growing sector, Influencity has once again set out to analyze the state of influencer marketing across the continent. In the 2022 edition, we analyzed over 10,000 Instagram influencers in 30 European countries to see how their digital ad spending, total population, and number of Instagram users impacted the number of influencers in each market.

Highlights

- In 2022, there were 252.1 million Instagram users in Europe. This means that 37.8% of the population living in Europe uses this app to connect, share photos, and make online purchases – an 18.4% increase from 2020.

- 10.5 million European Instagram users are considered influencers, a 22% increase in just 2 years.

- The total population of the 30 countries surveyed was 667.6 million, a slight decline from the previous study.

- Out of these 667.6 million people, 10,526,558 meet the influencer criteria set out in this study. This represents 1.6% of the total population surveyed.

- Investment in digital advertising soared to $89.4 billion, a 131.2% increase from 2020.

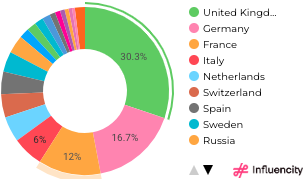

- The UK is once again the leader in digital advertising investment in Europe, with investment reaching $27.057 billion (30.3% of total spending).

- Germany replaced Russia in the number 2 spot with $14.96 billion spent (16.7%) and France came in third with $10.73 billion (12%).

- Russia continues to lead in the total number of Instagram users, with 55 million recorded in 2022. This represents 38% of the overall Russian population, up from 34% in 2020.

- Russia doesn’t just lead in the number of Instagram users, but also in the number of influencers. The Russian Federation is home to 3,182,441 influencers, 2.18% of the entire population. This is a significant increase from the 1.81% recorded in 2020.

- In 2020, the number of influencers in Russia was almost double that of the runner up, Italy. In 2022, Russia surpassed its previous record, more than doubling Italy’s total of 1,589,579 influencer profiles.

- The country with the smallest number of influencers is Luxembourg, with just 1,229 content creators meeting the study’s criteria (.2% of the country’s total population).

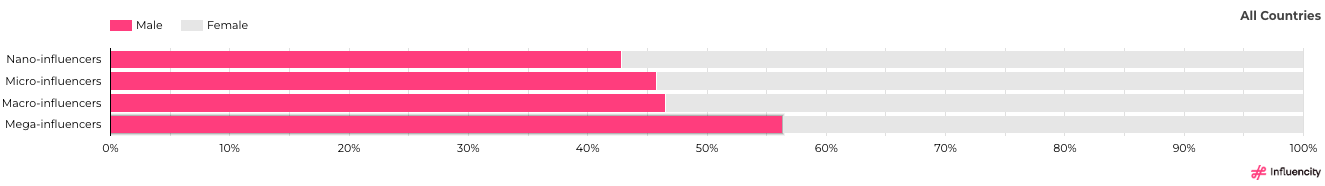

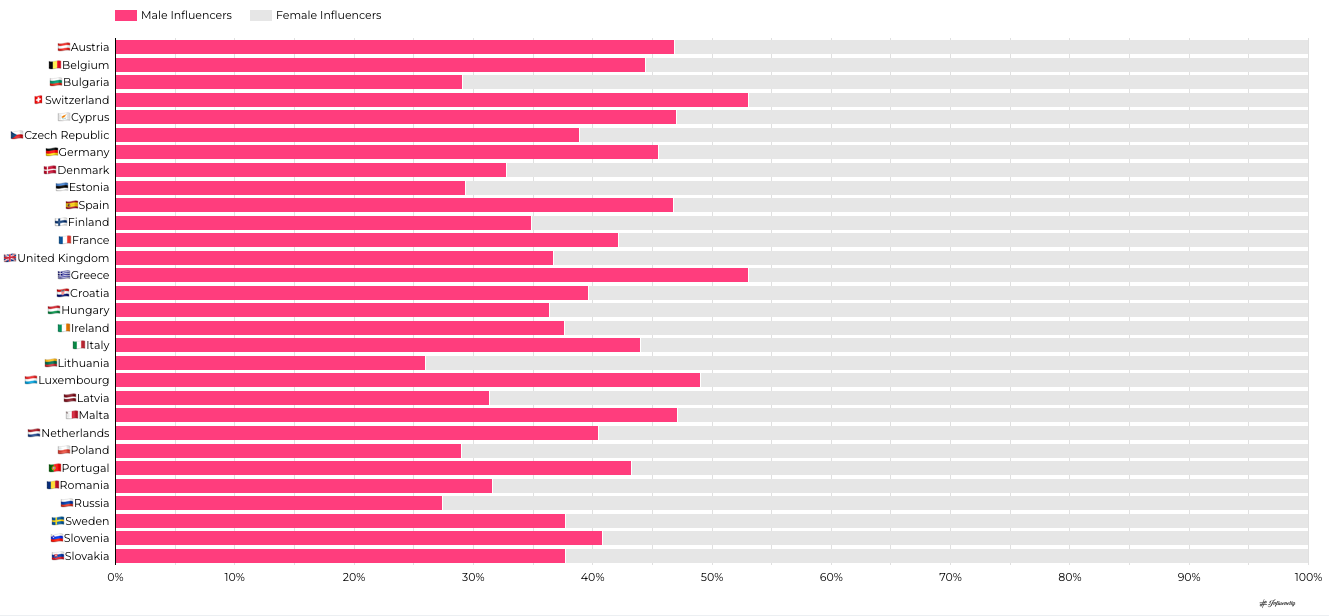

- The influencer demographic distribution held steady, with 62.5% of influencers recorded as female and 37.5% as male.

- As in 2020, Switzerland and Greece defied the trend of having more female than male influencers. Both countries continue to have substantially more male content creators.

- The nano-influencer category continues to be dominated by female content creators.

-

The mega-influencer category is still dominated by male content creators.

Survey Methodology

As with the 2020 study, we first measured digital ad spending and investment in the 30 European countries that made up this year’s survey. This data is based on patterns of digital advertising expenditure and predictions for total investment in 2022.

The total number of Instagram users includes all profiles – both public and private – and all age ranges. Data for this study came from the Statista Report on Digital Advertising in Europe.

In order for an individual to be considered an “influencer,” they must be able to influence the purchase decisions of their target audience. Users develop this authority by having specialized knowledge or expertise in a particular subject, such as beauty, travel, technology, or gastronomy. For the purpose of this study, influencers were also defined as those over the age of 18 with public profiles and over 1,000 followers. Although not all of these individuals have engaged in influencer marketing, meeting these criteria would make them eligible to do so.

As the influencer marketing sector grows, so does the jargon used to describe it. In order to categorize profiles according to their possible influence and reach, we sorted them into 4 categories as follows:

Nano-influencers: profiles with 1k - 10k followers

Micro-influencers: profiles with 10k - 100k followers

Macro-influencers: profiles with 100k - 1 million followers

Mega-influencers: profiles with 1 million plus followers

To further segment these profiles, we filtered each category by gender: male, female, and no-gender. A “no-gender” influencer is any user whose gender is not clearly evident or not relevant to their status as an influencer. This could include non-binary persons, pet accounts, or even brands.

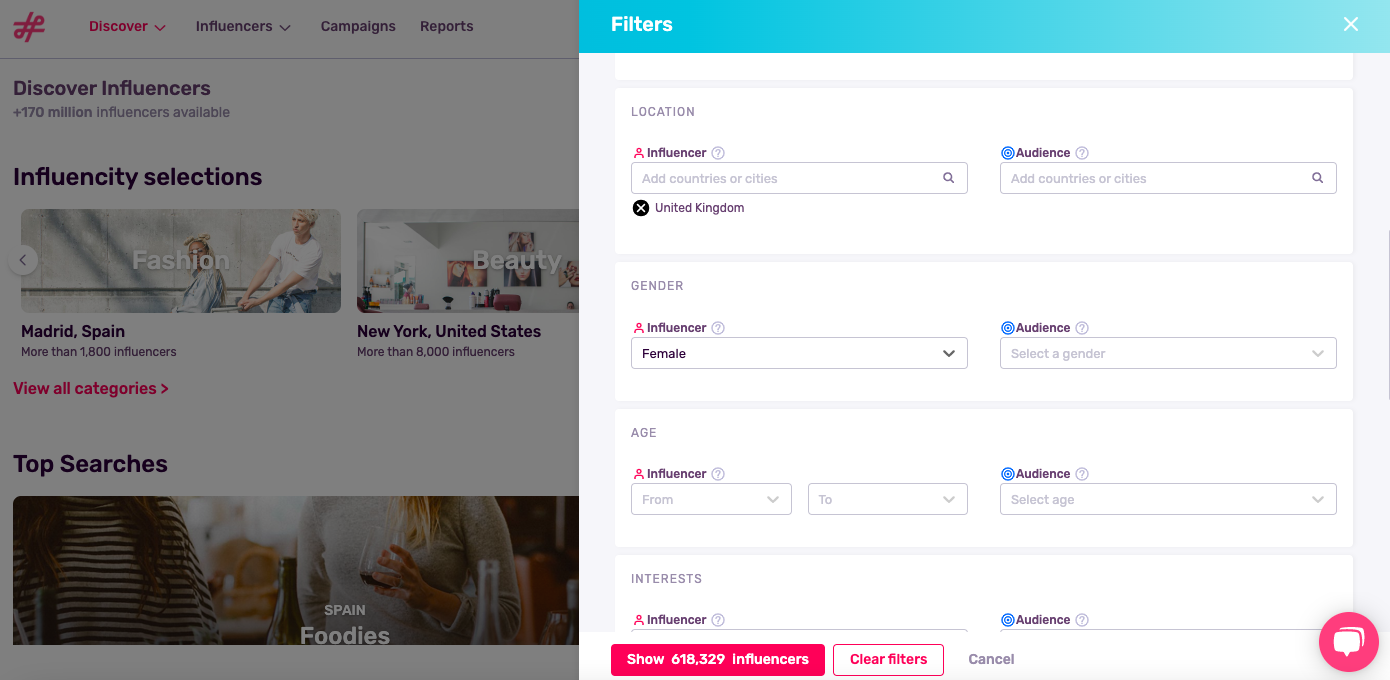

To gather real-time data on the number of influencers in each category and gender, we used Influencity’s own software. Influencity’s AI-powered platform uses image recognition and natural language processing (NLP) to understand data on any profile worldwide and other types of data publicly available. By setting filters to narrow down the number of followers, location, and gender, we are able to reduce this vast pool to know the exact number of male, female, and no-gender content creators in each of the 4 categories above.

An Ever-Growing Trend

As mentioned in the highlights, the number of European Instagram users has increased by 18.4% in just 2 years. The increase in profiles that could be considered to have influencer status is even more pronounced, showing a 22% jump. This impressive growth is despite the fact that the total population of the 30 countries surveyed has decreased since 2020.

What does this mean for the industry? While some argue that Instagram’s popularity is in decline, the reality is that as long as users keep joining the platform, marketers will continue to see it as a platform to attract and create relationships with potential customers. What may change, however, is the marketing funnel and social commerce structure. For our thoughts on this, jump to our section on The Future of Influencer Marketing below.

The UK as the Leader in Digital Advertising Investment

The market definition of digital advertising is the use of the internet to deliver marketing messages through various channels. This includes internet search advertising, banner advertising, video ads, social media ads, and classifieds.

As part of this study, we examined the amount of investment in each country’s digital advertising market to see the correlation between money spent and the number of professional influencers in each country. Our prediction is that the higher the investment in digital advertising, the more established the influencer market is expected to be.

Indeed, the countries with higher investment in digital advertising did have a higher total number of influencers. However, there were some exceptions, such as Italy and Russia, both of which have large numbers of influencers despite relatively low levels of investment in digital advertising.

Interestingly enough, while Russia may be 9th in investment, it is first in the total number of influencers with more than double the number of content creators than Italy, the runner-up (3,182,441 profiles in comparison to 1,589,579).

As seen in the chart below, the United Kingdom is the leader in investment in digital advertising (30.3% of the total investment in Europe), almost doubling that made by Germany (16.7%). These countries are followed by France, and Italy. This is perhaps unsurprising, as these 4 countries, together with Russia, hold a 50% share of the European economy.

Nano-Influencers Holding Strong

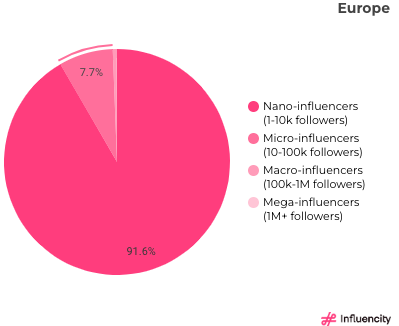

In 2020, 92.6% of the 8.6 million influencers surveyed fell into the category of nano-influencer. In 2022, this percentage decreased slightly to 91.6%.

The number of micro-influencers, however, increased to 7.7%. This change could be attributed not to a fall in the popularity of these profiles, but rather to their success. As businesses large and small realize the advantages of working with nano-influencers, they inadvertently push their following up, leading many nano-influencers to grow into micro-influencers in just a few years.

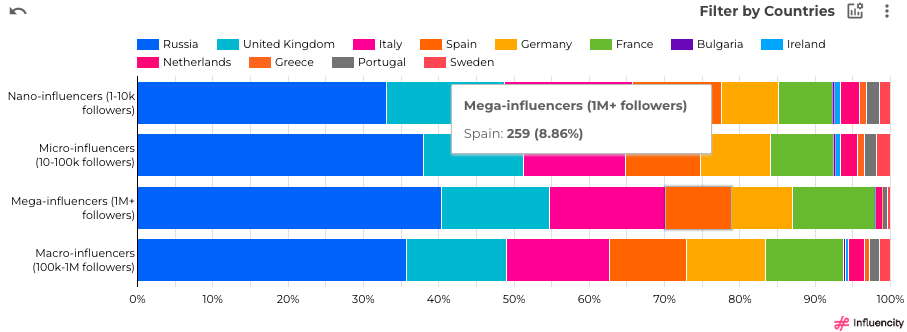

The Growth of Mega-Influencers in New Markets

As could be expected, the highest number of mega-influencers were found in the more established European markets: France, Germany, Italy, the United Kingdom, and Russia.

However, up-and-coming mega-influencer markets also showed a notable increase from 2020, such as Spain (259 macro-profiles in 2022 compared to 159 in 2020), the Netherlands (27 up from 24), Poland (74 up from 47), and Romania (27 up from 18).

As in 2020, many influencers have yet to break into mega-influencer territory and the majority of countries did not have any of these profiles.

Male Mega-Influencers in the Majority

As with the 2020 study, we found that female content creators made up the majority of nano-, micro-, and macro-profiles, while mega-influencers were largely male (56% or all mega profiles). These male content creators tend to be celebrities in their own right, such as actors, TV personalities, or professional athletes.

Switzerland and Greece Defy the Trends

As mentioned in the section above, female content creators make up the majority in almost every country surveyed. The only exceptions are Switzerland and Greece, where male influencers make up 53% of the total in both countries. This was also true in 2020, showing that both markets have remained unchanged in the past 2 years.

The Future of Influencer Marketing

The data confirms it: influencer marketing is on an upward trajectory. The question that remains, however, is what form it will take in the future and how it will adapt to ever-changing consumer preferences. What types of influencers will be best positioned to succeed in 2023 and beyond? How digital will we go and how will brands respond?

In our 2020 study, we found that the overwhelming majority of profiles that met our criteria fell into the nano-influencers category, that is, small-scale profiles with a narrow reach and high engagement. However, the 2022 study showed a slight decrease in these nano-profiles and an increase in the next level, micro-influencers (10k-100k). This suggests that these niche influencers are quickly amassing dedicated followings and may soon seek to professionalize in order to guarantee profits in the years to come.

This leveling up will be seen in both the profit model as well as the relationships that these creators seek to build with their sponsors. For example, as in-app shopping quickly becomes the norm, influencers increasingly become the entire marketing funnel. This means that their fresh, dynamic content will be earning them commissions on top of their collaboration fees. As influencers’ roles become more pronounced, we predict that partnerships will become stronger, more diverse, and more purposeful than ever. Companies will no longer select creators based purely on their numbers or aesthetics, but rather on the personal brand that these influencers have crafted for themselves.

Another noteworthy trend is the digital transformation, which continues to bring all aspects of life online. The placement of retail firmly in the digital space means that brands need to find new and creative ways to cut through the noise and differentiate themselves in this new online environment. This means new types of collaborations and a new reliance on user-generated content. Brands will no longer rely on influencers to create content, but rather to shape an entire culture and community around their brand.

Finally, as life moves online, marketers will increasingly rely on technology to make crucial decisions for their strategies. Manual searches and analyses will no longer be sufficient ways to gather influencer and audience insights at scale, and instead, marketers will need to harness the power of technology. Influencer marketing platforms that can mimic human analysis at scale will be increasingly important, as marketers seek to find the most sought-after hashtags and identify fraudulent followings. Fortunately, platforms are constantly adding to their tech suits to accommodate this need.

To conclude, the influencer marketing campaigns of the future will be driven by data. The sector will not remain static, but rather will adapt to respond to current trends, events, and preferences. For a full look at all the data from this article, discover the largest influencer study in Europe.

Want to stay on top of these trends? Subscribe to the Influencity blog where our experts and thought leaders will share insights on all that is influencer marketing.